Billing Software

Billing software is a tool that automates the creation, management, and tracking of invoices and payments, streamlining financial operations for businesses. It ensures accuracy, improves efficiency, and enhances customer satisfaction with professional and compliant billing processes.

Billing software is a digital tool designed to streamline the process of creating, managing, and tracking invoices and payments for businesses. It automates billing tasks, ensuring accuracy, efficiency, and compliance with financial regulations. Billing software is widely used across industries to manage customer transactions, generate financial reports, and improve cash flow.

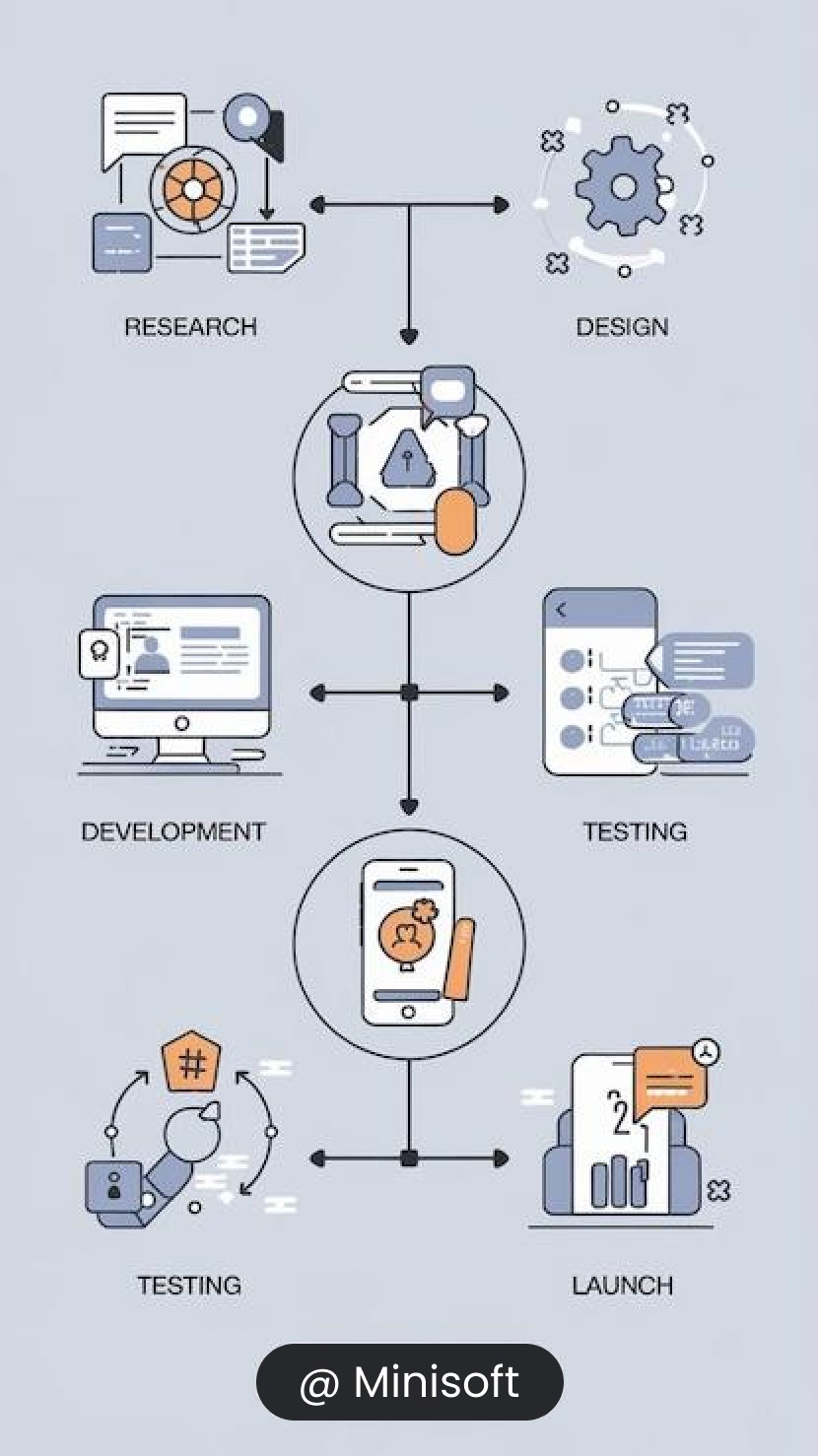

Work Flow Of A Billing Software?

A typical billing software workflow involves processes for generating, managing, and tracking invoices and payments efficiently.

Customer/Client Setup

- Customer Database: Input or import customer information such as name, contact details, billing address, and payment terms.

- Profile Management: Create unique profiles for each customer, enabling easy tracking of their transactions and balances.

Product/Service Setup

- Catalog Management: Define the products or services with details like description, unit price, tax rates, and discounts.

- Customization Options: Set unique pricing or discounts for specific customers if required.

Invoice Creation

- Generate Invoice: Create a new invoice by selecting the customer and adding products/services.

- Tax and Discount Calculations: Automatically calculate taxes, discounts, and totals.

- Customization: Add invoice numbers, issue dates, due dates, terms, and payment methods.

- Preview and Approval: Review the invoice before finalizing or sending.

Invoice Delivery

- Digital Delivery: Send invoices via email, SMS, or a customer portal.

- Print Option: Generate printable PDFs for manual delivery if required.

Payment Processing

- Payment Methods: Accept payments via multiple options like credit cards, bank transfers, digital wallets, or cash.

- Integration with Payment Gateways: Seamless integration for online payments, ensuring secure and quick processing.

- Partial or Full Payments: Record partial payments or split payments if necessary.

Payment Tracking

- Payment Status Updates: Track whether invoices are paid, partially paid, or overdue.

- Automated Reminders: Send reminders for upcoming or overdue payments to customers.

- Receipts: Generate and send payment receipts automatically once the payment is received.

Reports and Analytics

- Sales Reports: Analyze total revenue, sales trends, and top-selling products or services.

- Customer Insights: View payment histories, outstanding amounts, and recurring customers.

- Tax Reports: Generate tax summaries for compliance and easy filing.

Recurring Billing

- Subscription Management: Automate billing for subscription-based services.

- Scheduled Invoices: Set up recurring invoices for repeat customers.

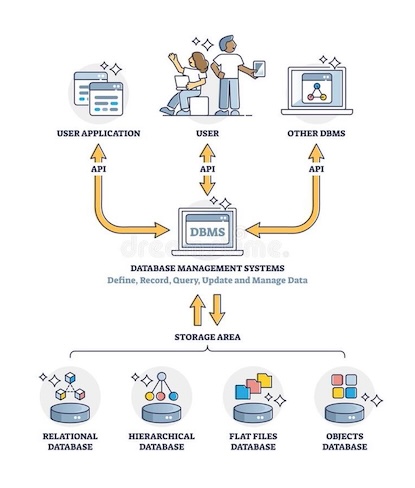

Integration with Other Systems

- Accounting Software: Sync data with tools like QuickBooks or Xero for financial management.

- CRM Systems: Integrate customer data to streamline sales and billing workflows.

- Inventory Management: Update stock levels automatically after invoicing.

Data Security and Compliance

- Secure Transactions: Use encryption for sensitive customer and payment data.

- Compliance: Ensure adherence to local tax laws, billing regulations, and data privacy standards.

Minisoft ecosystem encompasses the network of organizations, individuals, and resources that interact and influence its operations and success.

Benifits Of A Billing Software For Small Scale Business.

Billing software empowers small-scale businesses to operate efficiently, improve cash flow, and maintain professionalism, making it an essential tool for sustainable growth.

-

Time and Cost Savings

Automates invoicing, reduces manual errors, and eliminates the need for extensive paperwork, saving time and resources.

-

Improved Cash Flow Management

Tracks payments, sends automated reminders for overdue bills, and supports recurring billing for subscription-based customers.

-

Professional and Accurate Invoicing

Creates branded invoices with accurate tax and discount calculations, enhancing the business's credibility and compliance.

-

Real-Time Insights

Provides detailed reports on sales, revenue, and taxes, enabling informed decision-making and better financial planning.

-

Enhanced Customer Experience

Offers multiple payment options, faster service, and personalized invoices, improving customer satisfaction and loyalty.

Drawbacks Of Not Using A Billing Software

Not using billing software can lead to several drawbacks for small-scale businesses, impacting efficiency, accuracy, and overall growth.

Inefficient Invoicing and Payment Management

- Lack of Centralized Data: Customer and transaction details are scattered, making it hard to retrieve or manage.

- Difficulty in Tracking Payments: Overdue or partial payments may go unnoticed, leading to cash flow issues.

Reduced Professionalism

- Unbranded Invoices: Handwritten or basic invoices lack a professional appearance, potentially damaging the business's credibility.

- Inconsistent Formats: Non-standardized invoicing can confuse customers and make record-keeping challenging.

Compliance Risks

- Tax Calculation Errors: Manual tax computations may lead to non-compliance with local regulations, risking fines or penalties.

- Limited Record-Keeping: Storing and organizing financial data manually can lead to missing records during audits.

Missed Business Insights

- Lack of Reports: Without automated reporting, businesses miss insights into revenue trends, customer behavior, and financial health.

- Poor Decision-Making: Limited access to data and analytics hampers strategic planning and growth opportunities.

Inefficiency in Scaling

- Manual Processes Can't Scale: Managing an increasing customer base and transaction volume becomes overwhelming without automation.

- Delayed Operations: As the business grows, manual billing leads to slower processing times and decreased productivity.